A study on market predictions of eco ship’s engine and machinery

Copyright © The Korean Society of Marine Engineering

This is an Open Access article distributed under the terms of the Creative Commons Attribution Non-Commercial License (http://creativecommons.org/licenses/by-nc/3.0), which permits unrestricted non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited.

A survey is carried out for the future energy sources to be used for ship’s propulsion and ship’s machinery and operations. 44 global experts from Korea, America, Norway, Denmark, Japan and German who are currently working in the shipyard and offshore fields participated at the survey. Quantitative predications on the market shares of various energy sources, such as oil, LNG, fuel cell, wind energy, solar energy and nuclear energy are made. MPI (market prediction index) is considered as a quantitative index for easy comparison between future’s energy sources used for ship’s propulsion and operations. It is expected that the MPI of LNG becomes twofold in 2020 against ‘before 2016’. It could be also said that hydrogen based fuel cell is expected to increase rapidly for the coming years unless a new alternative energy appears

Keywords:

Expert survey, Energy sources, LNG, Fuel cell, Ship’s propulsion and machinery, Market prediction index1. Introduction

Global ship management (SM) companies have been trying to overcome the tough challenges from the competitions as well as high fuel price and ever strengthened environmental regulations. The efforts are focused on developing new technologies to comply the environmental regulations and to enhance the propulsion efficiency to reduce the fuel consumption. Since the environmental regulations are regarded as a mandate by themselves, it seems that their efforts and interests for keeping competiveness are mainly focused on using alternative fuels for ship’s propulsion and operations in addition to primary methods of those prime movers either for propulsion and/or for electricity generation. Although the call for the secondary method such as SCR and EGR with high pressure injection system so called "ME-GI" [1] to comply IMO Tier III [2], low pressure injection system requires to solve methane slip. To SM companies, LNG owing to intensive development of shale gas principally in Northern America has been thought to be an appropriate fuel which can satisfy the coming environmental regulations and economic competitiveness due to its price benefit. With this trend, there have been several cases that LNG fuelled ships had been built. LNG was not popular at least for the use as fuel at sea until a new horizontal drilling technology in which a hydraulic fracturing technology [3] was developed. This horizontal drilling technology provided economic feasibility to the shale gas, and USA launched several gas plants in huge scale for developing shale gas stations and commercialized them to LNG, eventually influencing lower price of LNG. Further, it seemed that Fukushima accident in 2011 ignited LNG market to be flamed. This made the huge demand at present and for the future of LNG enough to stipulate and to accelerate shale gas development further and the attempt of new building and conversion to LNG fuelled ships. ‘Tarbit Shipping AB’ recently converted the ship carrying chemical product.

'Bit Viking' to LNG fuelled ship in 2011 recorded as largest LNG fuelled ship conversion project [4]. US Shipping arm ‘Totem Ocean Trailer Express, called TOTE Inc’ placed an new building order in December 2012 as the world-first containership of which is operated by LNG fuelled two stroke (low speed) engine [5].

By the way, most of the SM companies and shipbuilders are not confident on the fact that LNG will be the only competitive fuel for the next decades to come. Their interests are in the future energy on fuel market for those prime movers either for propulsion and/or for electricity generation.

The purpose of this study is to provide the quantitative market indices of various energies used for ship’s propulsion and ship’s operations based on the survey from the global experts. The experts’ opinions on the future’s prospects were classified and quantified into 6 different energy sources, such as conventional oil, LNG, fuel cell, wind energy, solar energy and nuclear energy.

2. Predictions on Ship’s Engine Market based on Energy Source

Table 1 shows the format of survey which was distributed to 44 experts working currently in shipbuilding and offshore global companies. Their nationalities are Korean, American, Danish, Norwegian, Japanese and Germany. They were asked to estimate the percentage of an energy source to be used for ship’s propulsion among various energy sources, such as Oil, LNG, Fuel Cell, Wind Energy, Solar Energy, Nuclear Energy and Other Renewable Energy. They were asked to fill in Table 1 with their prospects on each energy source to be used for ship’s propulsion, and they were asked to consider the total percentage of each one should be 100%. That is, the percentage of each energy source should be relative value against other ones. Further, they were asked to predict the usage shares for the energy sources in Table 1 for three major periods, short term (before 2016), midterm (2016~2025) and long term (after 2025). Since the IMO regulation (TIER III) becomes effective from 2016, it was chosen for dividing three major periods

Survey sheet for the experts in shipbuilding and offshore industry on the future’s ship propulsions energy.

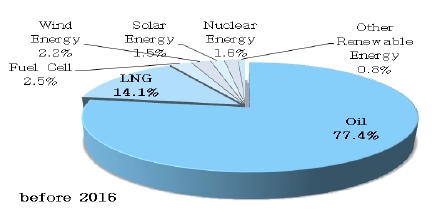

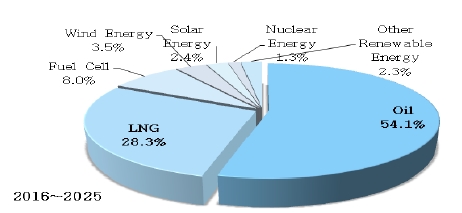

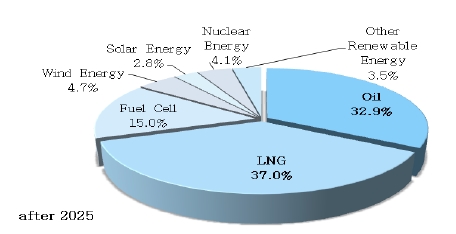

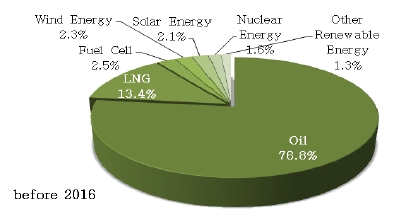

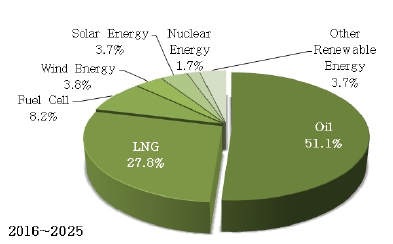

Figure 1, 2 and 3 show the results of the survey for the three major terms, respectively. The percentage shows the average values of the 44 experts’ reply. ship’ propulsion.

Before 2016, oil is still dominantly used for ship’s propulsion. Interesting thing is that LNG shares more than 14%. From 2013 to 2014 Q2, it is reported that the number of ships of which engines are operated with LNG fuel exceeds more than 60 [5]. Further, this number becomes double as shown in Figure 2.

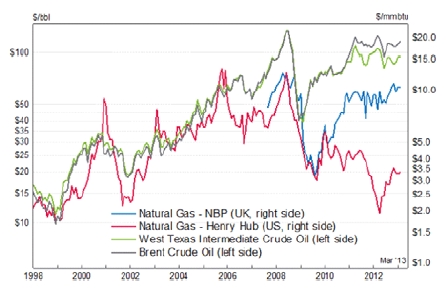

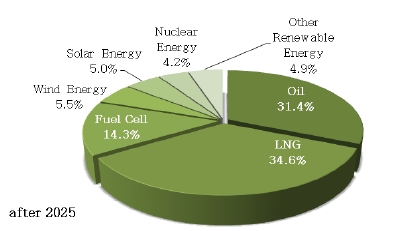

This trend implies that LNG fuelled ships will increase rapidly for the next two decades as shown in Figure 3. This trend can also be inferred from the prediction on the LNG price for the last 10 years as shown in Figure 4 which shows the price changes of oil and LNG for the last 10 years. Most SM (ship management) companies have been trying to save the ship’s oil consumption

Most SM (ship management) companies have been trying to save the ship’s oil consumption to be competitive. However, the IMO regulation (Tier III) on the air pollution from ships is to be effective from 2016, and SM companies are obliged to reduce NOx gases from ships up to 1.93~3.4 gr/kWh, which correspond to 80% lower than those of Tier I (2000. 1. 1). Technically speaking, there is no other countermeasure satisfying this regulation except using LNG as fuels.

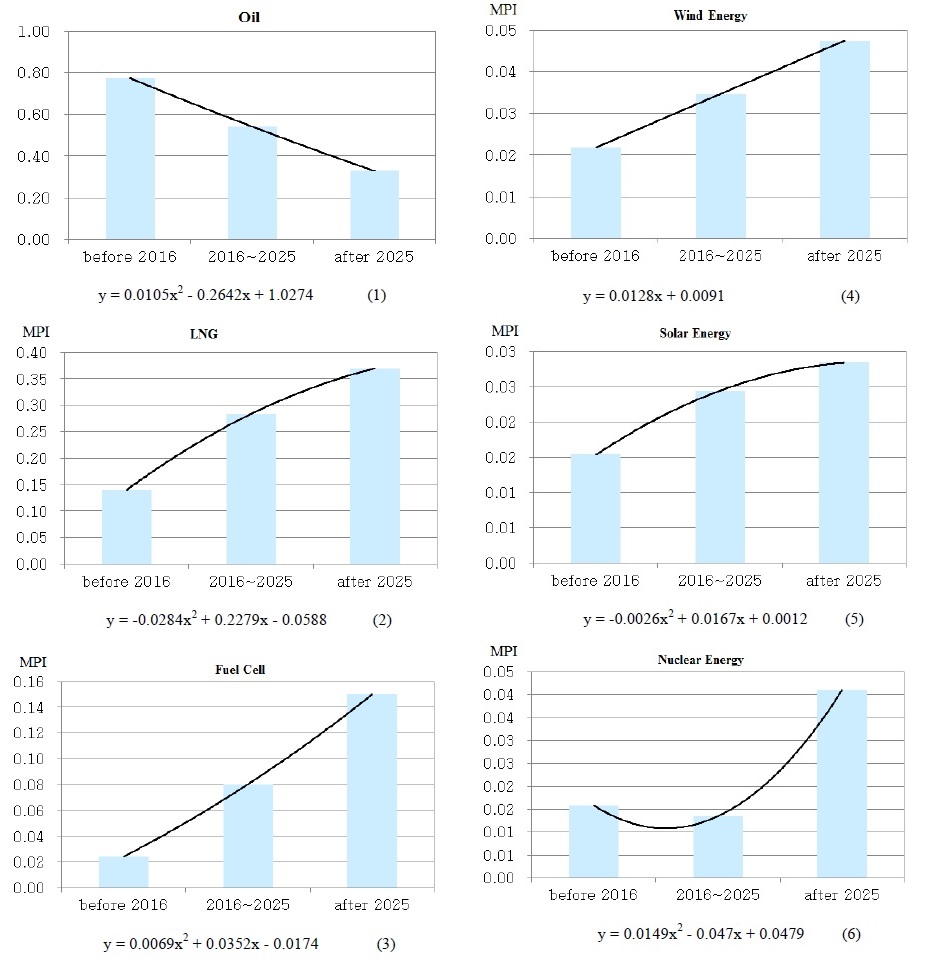

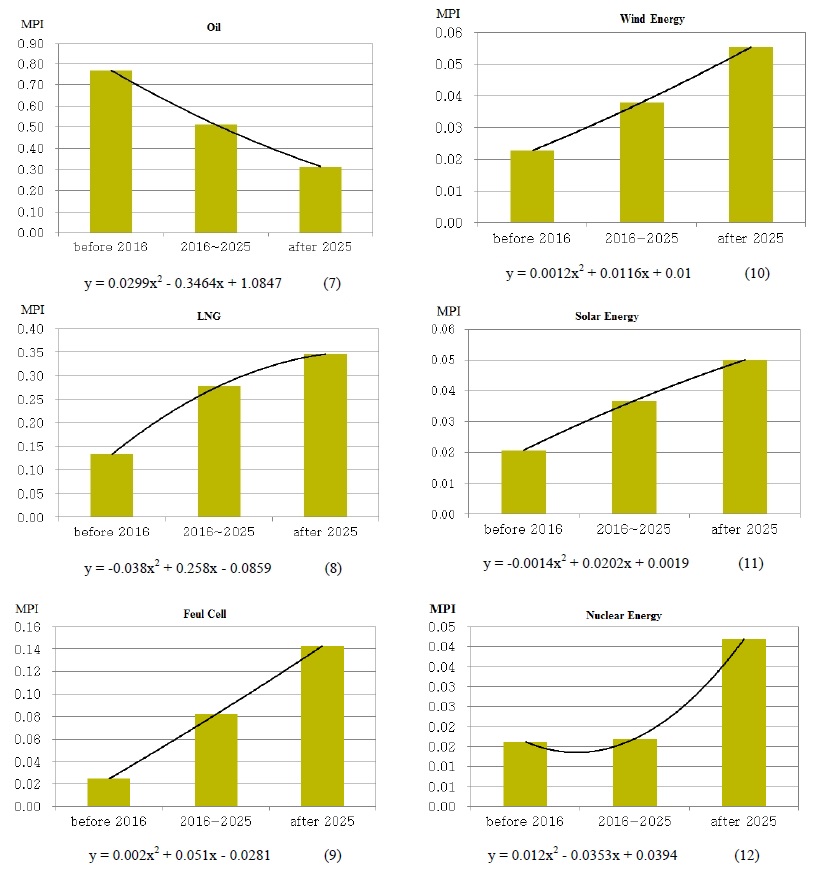

Figure 5 show market prediction indexes (MPI) for six different energy sources. MPI values imply the average values of the 44 experts’ reply for the percentages among all possible energy sources to be used for ship’ propulsion. The experts were asked to predict the percentage of an energy source which can be used for ship’s propulsion among the energy sources, such as oil, LNG, fuel cell, wind energy, solar energy, nuclear energy and other renewable energy.

From the figure for oil, it can be said that the percentage of oil to be used for ship’s propulsion will decrease to 30% after 2025. On the other hand, the percentage of LNG will increase up to 35% after 2025.

In order to predict the percentage linearly for all years, prediction equations expressed in Equation (1) ~ Equation (6) in quadratic form were obtained by using the three major MPI values in the figures. The ‘x’ values at 2016, 2020 and 2025 correspond to ‘1’, ‘2’ and ‘3’, respectively. Accordingly, the ‘x’ value at 2018 is 2.9896, and its MPI is ‘0.368’. This implies that the experts predict LNG will takes 36.8% among various energy sources used for ship’s propulsion. This percentage can also be inferred reasonably from Fig. 3 since this value is slightly lower than 37.0%.

More interesting fact is that the experts predict that the MPI of fuel cell will increase more than 700% in 2025 compared to that in 2015(before 2016). This prediction can be indirectly inferred from the fact that Hyundai Motor will release a commercial brandy new car in 2015 of which engine is worked by the hydrogen fuel cell, and Japanese government (Ministry of Economy and Commerce) published a strategy road map for Hydrogen and Fuel Cell Society on the 23rd of June in 2014.

3. Predictions on Ship’s Machinery Market based on Energy Source

Table 2 shows the format of survey which was also distributed with Table 1 to 44 experts working currently in shipbuilding and offshore global companies. They were also asked to estimate the percentage of an energy source to be used for ship’s machinery and operation among various energy sources, such as Oil, LNG, Fuel Cell, Wind Energy, Solar Energy, Nuclear Energy and Other Renewable Energy. They were also asked to fill in Table 2 with their prospects on each energy source to be used for ship’s machinery and operation considering the total percentage of each one to be 100%. That is, the percentage of each energy source should be relative value against other ones. They were also asked to predict for three major periods, short term (before 2016), midterm (2016~2025) and long term (after 2025).

Survey sheet for the experts in shipbuilding and offshore industry on the future’s ships machinery energy.

Figure 6, 7 and 8 show the results of the survey for the three major terms, respectively. As in the case of ship’s propulsion, oil is still dominantly used for ship’s machinery and operation before 2016. LNG shares 13.4% slightly lower than the case of ship’s propulsion 14% before 2016.

However, this share becomes doubled for the midterm as in the case of ship’s propulsion energy. This trend also implies that LNG will be increasingly used for ship’s machinery and operation for the next years. As explained in the above, this trend is mainly due to two major reasons. One is low cost of LNG and the other one is its robustness for the environmental regulations.

As pointed out for the case of ship’s propulsion energy, the fuel cell is expected to be more than sevenfold increase after 2025, though commercialized cases are still lower than 1%.

4. Conclusions

A survey was carried out for the future energy sources to be used for ship’s engine and ship’s machinery and operations. Based on the opinion of 44 global experts currently working in the shipyard and offshore fields, quantitative predications on the market shares of various energy sources, such as oil, LNG, fuel cell, wind energy, solar energy and nuclear energy were made.

MPI (market prediction index) was considered as a quantitative index for easy comparison between future’s energy sources used for ship’s propulsion and operation.

It is expected that MPI of LNG becomes twofold in 2020 against ‘before 2016’. This implies that the usage of LNG increases 2% each year additionally from 2013 until 2025.

Further, hydrogen based fuel cell is expected to increase rapidly for the next coming years unless a new alternative energy appears. It could be said from the experts’ prediction on future energy sources used for ship’s propulsion and operations that gas era had already started.

Acknowledgments

This study was supported by the Korea Maritime and Ocean University Research Fund in 2013, and partly by the Production Technology Commercialization Support Program through Ministry of Industry Ordinary (10-04) of KICOX.

This paper is extended and updated from the short version that appeared in the Proceedings of the International symposium on Marine Engineering and Technology (ISMT 2014), held at Paradise Hotel, Busan, Korea on September 17-19, 2014.

References

- G. Ole, “Gas utilization in propulsion systems with MAN B&W low speed engines”, Proceedings of the JICEF Seminar, Kobe, MDT Copenhagen, (2014).

- IMO, Resolution MEPC.66.

- G. E. King, “Hydraulic fracturing 101”, Journal of Society of Petroleum Engineers, Paper No. 152596, p2-3, (2012).

- K. Sören, “LNG fuelled ship conversion project”, WÄRTSILÄ Technical Journal, 1, p23-24, (2012).

- News Article, “World’s first LNG-powered container ships to serve puerto rico for TOTE, Inc.” , [Online] http//www.toteinc.com (2012).